3 Bad Habits That Can Destroy Your Budget

While creating a budget is the responsible thing to do if wealth creation and debt minimization is on your bucket list of things to do, it’ll be hard to stick to a plan if you lack the discipline.

Yes, sometimes life throws a curveball or two, and this might require you to spend more in certain situations than you otherwise would. But even in such situations, good habits on the savings front can give you a tangible rainy day fund from which to draw if the furnace breaks or the roof leaks.

One thing’s for certain, all of the personal budgeting goals in the world will amount to little if you can’t stick with the program. So unless you plan to change careers to make more money, you might need to tighten your belt and learn to do more with less.

With that said, consider these 3 bad habits that can destroy your personal budget — and force you to perhaps take on wealth-destroying debt to make ends meet.

Addictive Personality

Unfortunately, an addictive personality can ruin your budget and leave you in debt. What is an addictive personality? It basically refers to a habit that is hard to beat. For instance, some people simply have to buy expensive lattes at their favorite retailers…every day or to head out to restaurants during every lunch break. While doing these things on occasion isn’t wrong, making a habit of it can ruin you financially, especially if you’re on a tight budget as it is. If you ponder how much your regular small purchases are costing you weekly, monthly, or yearly, you might get a bit of a reality check, and this might be enough to compel you to adjust your behavior.

Shopaholic

If you’re the sort of person who likes to shop till you drop, so to speak, you might be a shopaholic, which is a term used to refer to people who find themselves unable to control their urge to keep spending on stuff whether they actually need the stuff or not. You need to get this problem nipped in the bud if you suffer from it, because it can really ruin your budget.

If you’re wondering if you’re truly a shopaholic, otherwise known as an oniomaniac, consider the following questions:

- Do you spend a lot of your time either buying stuff or thinking about purchasing stuff?

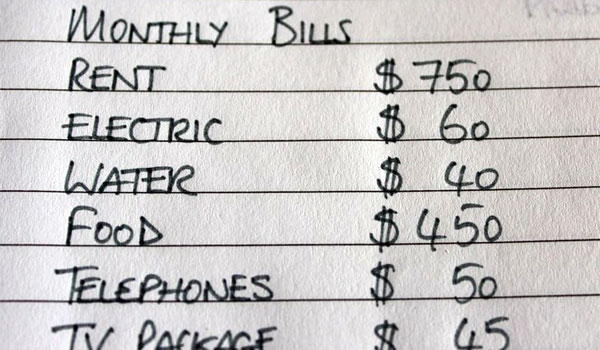

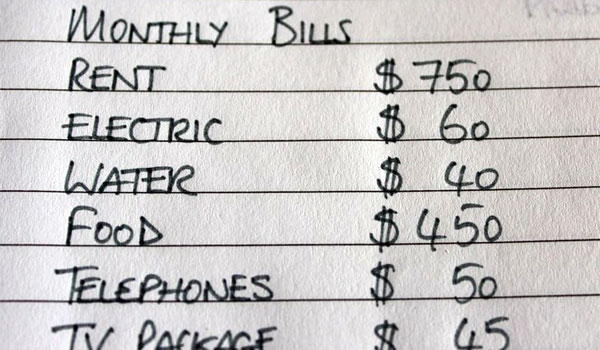

- Does your buying sometimes compromise your ability to meet your regular cost-of-living expenses?

If you can’t stop either buying or thinking about your next purchase and if you sometimes have a hard time meeting your basic cost-of-living expenses because of your spending, then you need to come to grips to overcome the problem.

Spend Beyond Means

Are you the sort of person who tends to regularly spend beyond your means rather than to delay self-gratification until you can actually afford the stuff you want? This is a dangerous habit that can wreck your budget and sink you further and further into debt. When you make a budget, ensure that it’s realistic so that it’s something you can stick with. Make a distinction between your needs and your wants. Whatever qualifies as a want can wait until you can afford it.

The 3 bad habits mentioned above can definitely do a number on your budget and get you into financial trouble. If you have any of these problems, get a grip and get help if you need it. The sooner you overcome these shortcomings, the better off you’ll be financially.

Pingback: How Much Should You Keep In Savings For A Rainy Day?